There is no question that the housing market is getting better. I would argue that it will never be at the fevered level it was pre-recession. We probably shouldn’t wish for it either because the housing bubble was a major factor driving the worst recession in our country’s history since the Great Depression.

There is no question that the housing market is getting better. I would argue that it will never be at the fevered level it was pre-recession. We probably shouldn’t wish for it either because the housing bubble was a major factor driving the worst recession in our country’s history since the Great Depression.

Read my post on The Big Short if you haven’t seen the movie or read the book and you’ll understand better why things got out of hand. But you might wonder what residual effects are still holding things back.

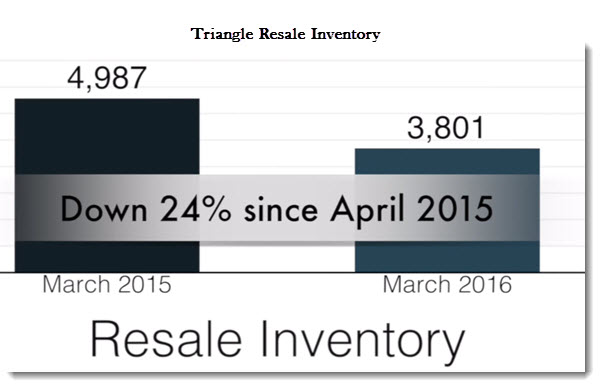

In the last couple of weeks, the Triangle Multiple Listing Service reported good news. In our market, sales are up from last year, time on the market is shrinking, and prices are rising, especially in the segments under $400,000. We’re even seeing houses sell for more than their asking price, something very unusual in recent times. Showings are way up meaning there are people actively looking for homes.

The bad news is that fewer houses are going on the market. This leaves fewer choices for buyers and more upward pressure on prices.

Sounds like it’s all bad for buyers and great for sellers. Yes and No.

Let’s address the inventory issue first. The biggest obstacle is that in spite of rising prices now, trillions of dollars’ worth of equity disappeared during the recession making it much more difficult for millions of home owners to “move up.” Even folks that didn’t run equity lines up to the limit don’t necessarily have enough equity to meet more stringent down payment and credit requirements to make the jump. Which is, of course, the second thing holding them back from putting their home on the market. Lenders and appraisers and the various semi-governmental institutions that support the mortgage market are much more cautious than they were just a few short years ago.

Builders find themselves in a similar dilemma and face rising costs for materials and land. Some very good builders had to get out of the business. While I was trying to get through the recession selling plumbing stuff at Home Depot I would talk to builders who before the recession were used to building palaces and never set foot in store, who were gathering supplies trying to do repairs, small renovations, garages, decks or whatever it took to survive.

So what is the advice we have for sellers, especially those that really want to move up or downsize in retirement? First, you seldom see people bidding up the price on dumps unless the seller is actively pursuing the “dump” pricing strategy. There is actually nothing wrong with this as long as it is intentional.

Knowing market trends is important and the best way to take advantage of a rising trend in prices is still to be special…show like a jewel and you’ll have buyers crawling all over you in this market. Don’t blow it during the Due Diligence period. Most people who back out of a contract during Due Diligence do so because of some inspection issue. The best way to avoid this is to do a pre-listing inspection and take care of the issues before you put the home on the market. This might sound counter-intuitive, but buyers who are following around the inspector during an inspection when nothing comes up are much less likely to walk away from the deal during the due diligence period.

If your home shows well and is in good condition you will get lookers. Not everybody agrees with me on this but if you need to maximize your net..that is, the check that you get at closing, don’t be afraid to be aggressive in the pricing. If you have to come down some to get an offer, that is easily done. Generally, in any price negotiation, the one who offers the first number is at a disadvantage. Since you have to put a price in the MLS, that means you. So if you don’t want to leave any money on the table, start the negotiations higher than you expect to get. But once again, the better your home looks and the better condition it is in the better your chances are of avoiding painful price and repair negotiations.

So, what if you’re a buyer and you want to nail down a home at a good price? Well, there are some strategies for doing that as well. But, I’m going to save them for another post about the Due Diligence period. Sign up and you can get it delivered to your email box and you won’t have to come look for it.